Market Trends

Airbus Global Market Forecast projects demand for nearly 40,000 aircraft by 2041

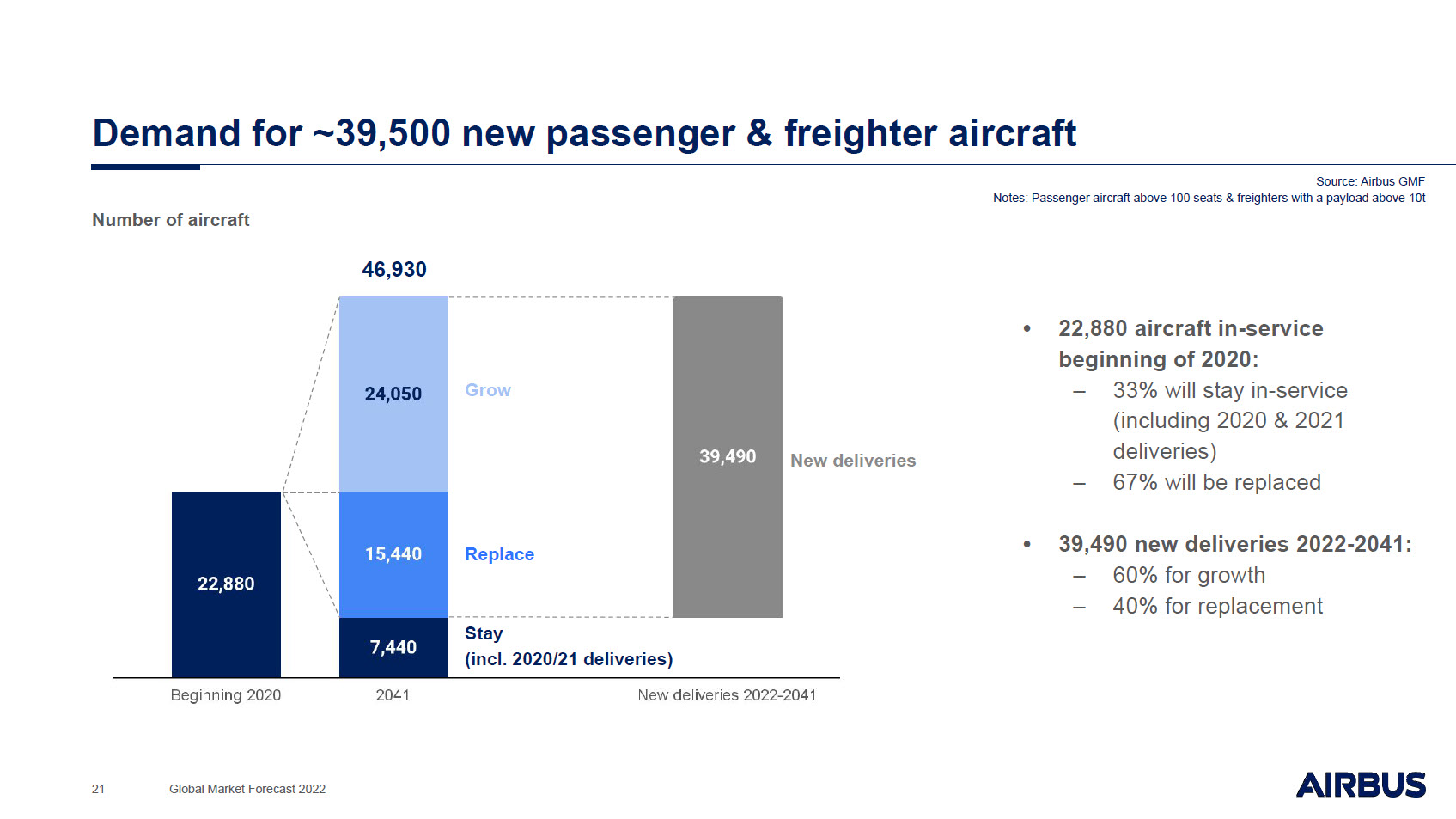

The 2022 edition of Airbus’ Global Market Forecast (GMF) reveals a projected demand for approximately 39,490 new passenger and freighter aircraft by 2041, representing 470 more planes over the previous year’s forecast.

Among the new aircraft deliveries, 40 percent - or 15,440 aircraft - are forecasted to replace the existing fleet, while more than 24,000 airplanes will drive the commercial aviation sector’s growth. Today, only 20 percent of the current in-service fleet is composed of fuel-efficient aircraft from the latest generation. New aircraft will contribute to the short term priority of decarbonizing the aviation industry by replacing the remaining 80 percent of previous generation fleets.

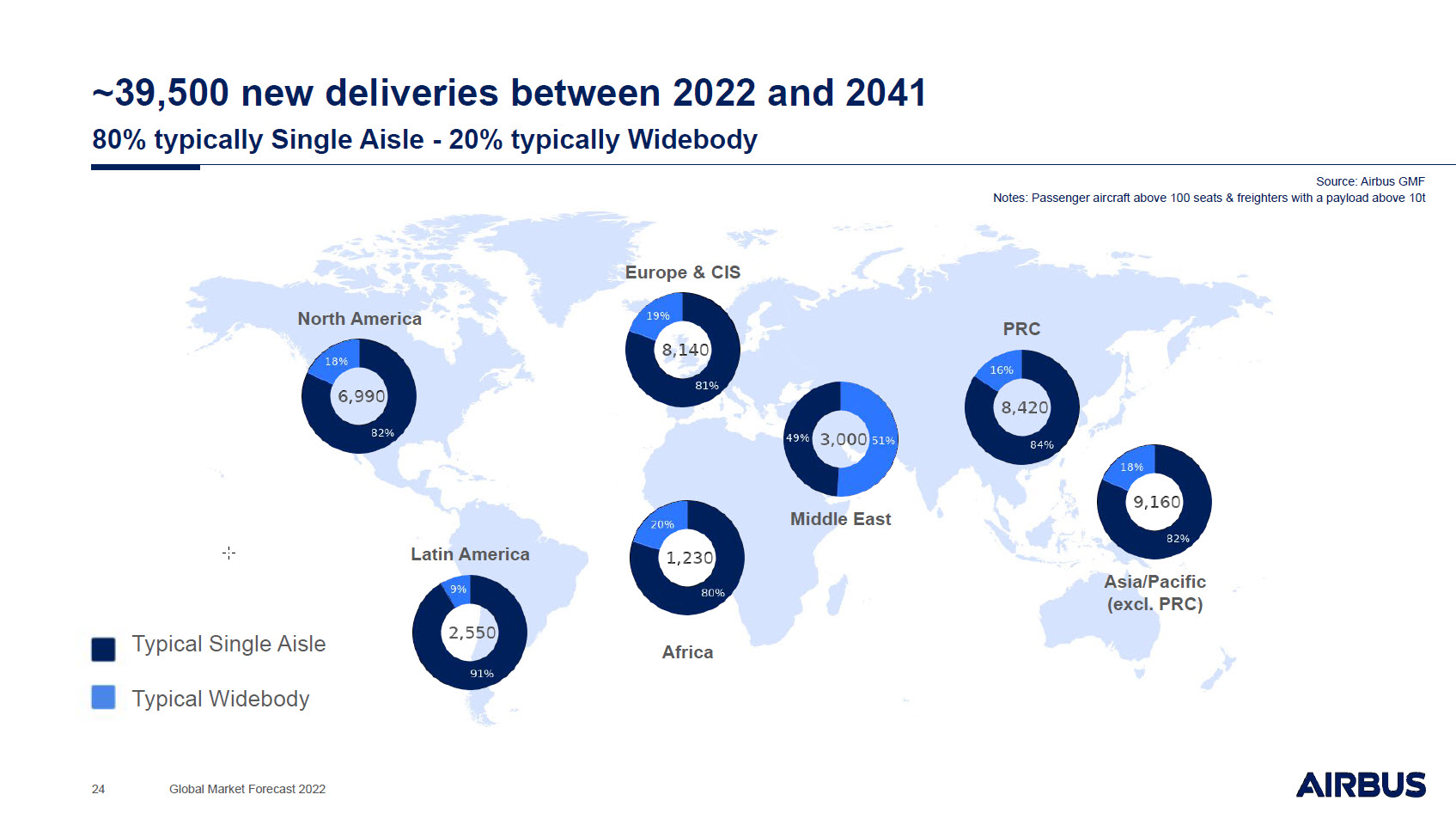

As part of the 2022 GMF, Airbus introduced a new global demand split per aircraft type: “Typically Single-Aisle”and “Typically Widebody’’. According to this new categorization, 80 percent of global demand will fall into the “Typically Single-Aisle” category, while the remaining 20 percent will come from “Typically Widebody’’ representing 31,620 and 7,870 aircraft of new passenger and freighter aircraft, respectively.

In Latin America and the Caribbean, 2,550 new-built aircraft are expected over the next two decades, 91 percent of which are forecast to come from the “typically single-aisle” category, the world’s highest such percentage over “typically widebody.”

The Global Market Forecast 2022 is based on a set of energy prices and macroeconomic assumptions mostly reflecting the International Energy Agency STEPS (Stated Policies Scenario), including Sustainable Aviation Fuels (SAF) mandates and announced CO2 prices. As a result, according to the new GMF release, the global passenger traffic is set to grow annually by 3.6 percent (2019-2041 CAGR - Compound Annual Growth Rate) over the next 20 years, reflecting higher energy cost and the likely effects from assumed price elasticity of demand.

On the cargo side, the GMF foresees a demand for around 2,440 freighters in total (new aircraft and conversions), among which around 900 are new-built. These aircraft will serve freight traffic growth at 3.2 percent annually between 2019 and 2041, boosted by e-commerce expected to grow at 4.9 percent per year while general cargo, representing three quarters of the total market in 2041, shows an annual 2.7 percent growth.

Click here to learn more about our GMF forecast.

For more information contact:

Damien Sternchuss

HO Airline Marketing Latin America & Caribbean

damien.sternchuss@airbus.com