Top Story

Latin American Services Market Set to More than Double by 2044

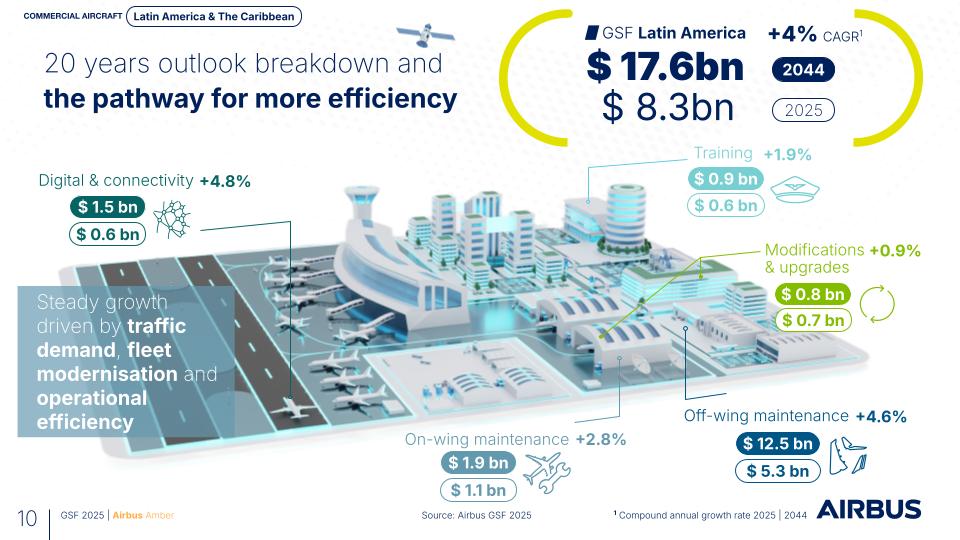

The Latin American and Caribbean aviation services aftermarket is poised for a period of expansion, with the total services market to more than double over the next two decades. According to the Global Services Forecast (GSF) 2025-2044, the market is expected to grow from $8.3 billion to $17.6 billion by 2044.

Fleet Renewal Driving Demand

This aggressive growth is fundamentally linked to fleet growth and renewal. By 2044, the region's fleet will nearly double to 2,750 aircraft. This increase will be driven by 2,660 new deliveries, with a strong focus on single-aisle aircraft. This fleet expansion fuels robust demand across critical service clusters essential to operational growth, including Maintenance, Modifications & Upgrades, Digital Operations & Connectivity, and Training.

Strategic Trends: Optimization and Regional Capability

As the in-service aircraft in Latin America and the Caribbean grows, airlines adopt strategies to manage its fleet transitions by simultaneously maximizing the value of current fleets, while integrating new-generation aircraft. This "dual approach" is accelerating the adoption of alternative material solutions, such as Used Serviceable Material (USM), which are certified parts from retired aircraft.

The region is seeing a rise in nearshoring. Countries such as El Salvador, Puerto Rico, and the Dominican Republic are becoming strategic Maintenance, Repair, and Overhaul (MRO) hubs. These locations are perfectly positioned to capture both local and North American demand, enhancing regional efficiency.

To support this growth, workforce development is a top priority. Over the next 20 years, the region will require 132,000 new skilled professionals to maintain the expanding fleet. This talent pipeline includes:

● 42,000 New Technicians

● 35,000 New Pilots

● 55,000 New Cabin Crew

Major Services Markets in the region:

● Off-wing Maintenance (Engine and Component shop work) is the largest cluster, projected to reach $12.5 billion, representing almost 70% of cumulative demand, making material and digital solutions like Predictive Maintenance becoming crucial to manage inventory risk and accelerate shop efficiency.

● Digital Operations & Connectivity is forecast as the fastest-growing segment, expanding at a 4.8% CAGR to $1.5 billion, as the region prioritizes technology to unlock an estimated $0.7 billion in annual operational savings for airlines by 2044.

The Latin American and Caribbean aftermarket presents one of the most sustained growth cycles in aviation history. Capitalizing on it requires immediate and strategic action.

The key imperatives for the next two decades include a profound digital transformation to maximize data interoperability, continued investment in talent development, and the cultivation of resilient, diversified supply chains. By navigating this landscape with innovation, the region is well-positioned to capture vast future opportunities.

Click to explore: The complete figures powering this forecast are now accessible through a new interactive view on Airbus.com. We invite you to explore the data firsthand to see how these trends will shape the region.

For more information contact:

Susana Porras Fresneda

Aftermarket Intelligence & Strategy Latin America

susana.porras-fresneda@airbus.com