Market Trends

Economic slowdown, increased competition top concern for regions' airlines

According to the latest Noticias survey on Latin America and the Caribbean aviation market, more than half of the region’s airlines remain cautiously optimistic about the near future due to the economic slowdown and increased competition. But in spite of record-low fuel prices, fuel burn still remains an important concern for fleet decision makers.

Earlier this year, Noticias Airbus concluded a regional survey on market trends and best practices as related to airline fleet decisions. Detailed results, which confirm global trends, can be downloaded here. Following are some highlights:

Industry Trends

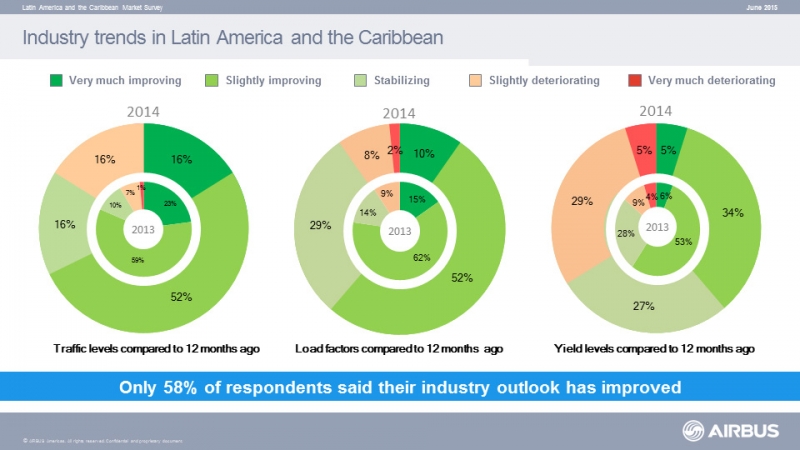

While overall perception remains that traffic levels and load factors have improved over the last 12 months, respondents said the situation regarding yields tends to be more neutral. Survey results showed that the market remains quite optimistic (at 58 percent) regarding the near future of the aviation industry, with the economic slowdown and increased competition being major elements negatively affecting growth.

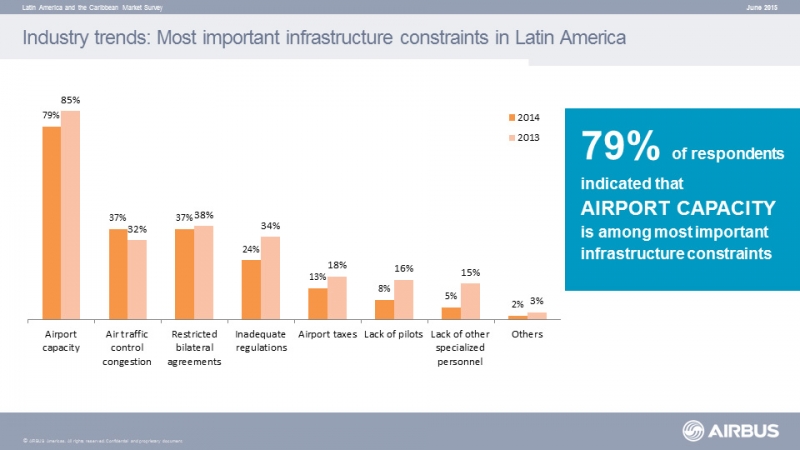

According to the survey, the most important long-term network development opportunity in Latin America remains intra-regional connections. As far as infrastructure constraints, respondents ranked airport capacity, air traffic control congestion and restricted bilateral agreements high on the list.

The survey highlights that more long-haul, single-aisles aircraft are expected to open new routes and fly side-by-side or even replace wide body aircraft.

Other significant regional trends to watch out for according to survey participants include the importance of becoming part of a global airline alliance, the possibility of further airline consolidation, the growing role of belly cargo, the importance of hubs and the Low Cost Carrier (LCC) expansion.

Fleet Decisions

As with the 2013 survey, airline criteria for selecting new aircraft include fuel burn, fleet rationalization/commonality and ability to generate more revenues. Airlines also indicated that they needed to see cost savings of at least 14 percent to transition fleet to same generation aircraft and 21 percent savings to new generation aircraft.

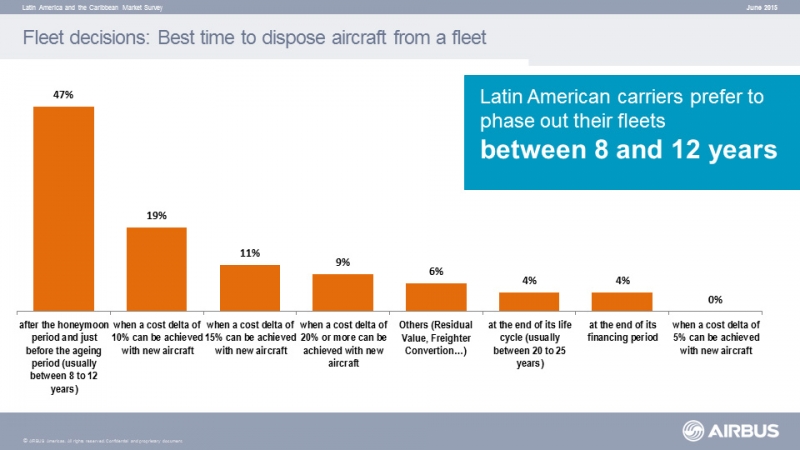

Survey takers said the best age to replace aircraft is between eight and 12 years or when a 10 to 15 percent cost difference can be achieved. Fleet decision makers said they prefer latest technology aircraft that deliver lower costs and generate higher revenue and simpler fleet structure.

The latest Noticias survey also pointed out that 86 percent of future single-aisle requirements will require larger modules than those in-service today, while only 54 percent of future wide body requirements will be for larger modules.

Perception of Airbus

Respondents upheld a strong brand perception for Airbus, with the “Airbus” brand leading in nine out of 10 questions. Airbus got top scores for “highly innovative aircraft manufacturer,” “most integrated family of products” and “superiority in manufacturing high quality and reliable products,” while being considered yet again as a “trusted supplier” that anticipates market trends.

Latest Noticias Market Survey click here

To check out the 2013 edition of the Noticias Market Survey click here

For more information contact:

Patrick Baudis

Vice President Marketing - Americas

patrick.baudis@airbus.com