Market Trends

Today's markets impose new wide-body requirements

The aviation market has changed dramatically over the last 10 years, in such a way that market requirements for wide-body aircraft now cover a large spectrum from domestic operations to ultra long-haul flights. For an aircraft manufacturer, figuring out what is right for the market is not always easy, especially if you also consider other requirements such as fleet simplification, operational flexibility and of course, the right economics.

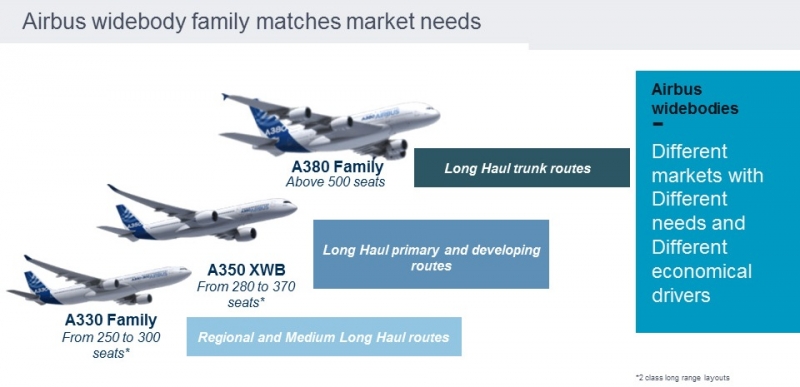

Airbus has developed a very clear wide-body strategy that answers such new market requirements, while matching, if not exceeding, all necessary criteria.

Some domestic operations require wide-bodies to address slot-constrained airports, high growth/volume and large hubs. We see today such requirement in Asia, China, India and anticipate that trend to reach the Americas in about 10 years.

Key elements for success for a wide-body in short-haul markets are operational reliability, maintenance costs adapted for short cycles, short turn-around times and a denser cabin adapted to such short missions. In this case, the A330 Regional is the Airbus answer, as it is an adapted version of the A330 offering lower MTOW (as range is not needed), 20 percent lower maintenance cost through lower thrust engines and a high 99.4 percent reliability (as seen on average for the A330 worldwide) with a unit cost as low as the A321neo!

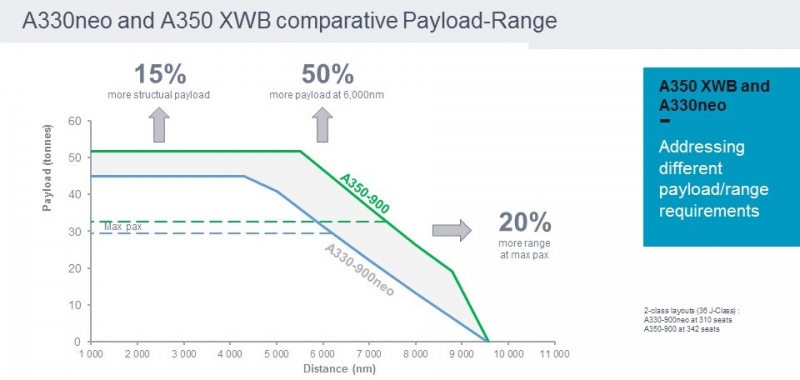

For longer-haul operations, requiring from 250 to 300 seats, the criteria becomes low fuel burn, high reliability, maximum network flexibility. In other words, turn-key solutions with lowest all-in costs. Today’s competitive environment makes it difficult for all-new platforms to offer compelling economics in Direct Operating Costs terms, i.e., including ownership costs. This was the basis for the recent launch of the A330neo Family; a re-engine solution based on the successful A330 platform, offering 14 percent lower fuel per seat and an increased range of up to 350nm. Making it the perfect tool for North transatlantic operations or North-South routes in the Americas.

For even longer missions and for capacity between 300 and 400 seats, there is a huge pressure on profit margins as yields decline with distance. Here, the objective is about reducing operating costs to the lowest level, in particular fuel burn, to recover profit margins. The soon-to-enter-into-service A350 XWB is offering what it takes for such markets, with a range of up to 8000nm, 25 percent fuel improvement as compared to previous wide-body generation and an all-new technology required by such long haul missions.

Now for large traffic volumes out of large hubs, where airports are saturated and the best profitable way for airlines is not to increase frequency but to rely on existing slots and increase capacity, Airbus offers the unique A380. Its large floor space allows a unique capability to generate revenues by segmenting finely the market through well-defined fare classes and distinct seat products. Airlines today flying several wide-bodies per day on some of these routes are clearly leaving a lot of profit on the ground by not operating the A380.

What makes this segmentation even better for airlines is that ultimately, it leads to fleet simplification thanks to a unique and extensive commonality between each of these Airbus models. A330 and A350 common type rating (same license for pilots to fly both aircraft) and Cross-Crew Qualification (reduced crew training times when transitioning from one aircraft to another) between A330, A350 and A380 allow airlines to benefit from reduced crew costs and full operational flexibility when it comes to deploy those aircraft across the network.

For more information contact:

Patrick Baudis

Vice President Marketing Americas

patrick.baudis@airbus.com