Top Story

Fuel Matters

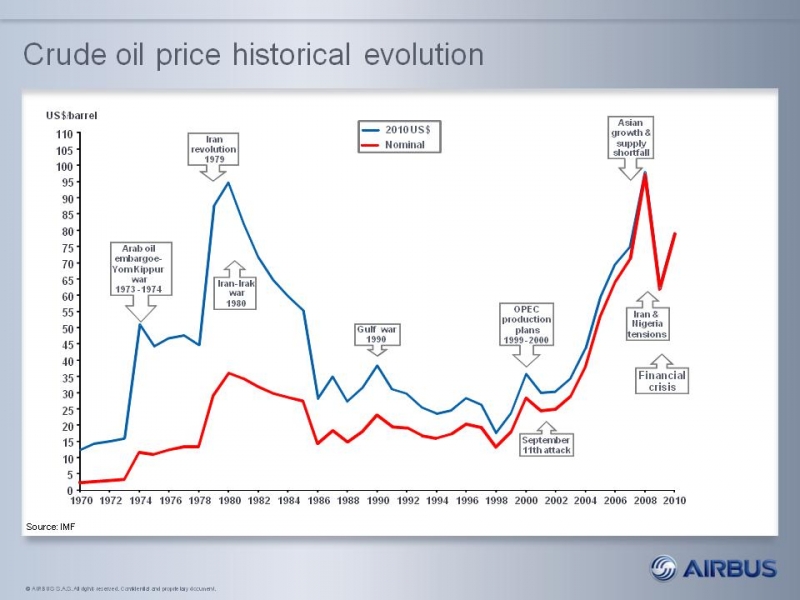

The average worldwide estimated jet fuel spot price has reached the mythic 300 US cents/USg for the first four months of 2011. In laymen’s terms, the corresponding average crude oil price for the same period is now well above US$100/barrel. The last time prices reached these levels were in 2008, marking the beginning of the worst financial crisis since the Great Depression.

Today, current prices reflect Northern Africa - Middle East instability, as well as the high demand rates in China and other developing countries. Speculation also plays a key role in oil price variations. It is estimated that in 2010 the quantity of crude oil traded in exchange markets represented some 20 times more than the physical world consumption! This amount is only growing and it has actually become the most traded commodity in the world.

If we look back in history, prices were fixed by oil companies, governments and OPEP. However, since 2004, a more direct supply and demand trading market has been implemented, mainly due to the development of the commodity stock markets and the growing demand of developing countries.

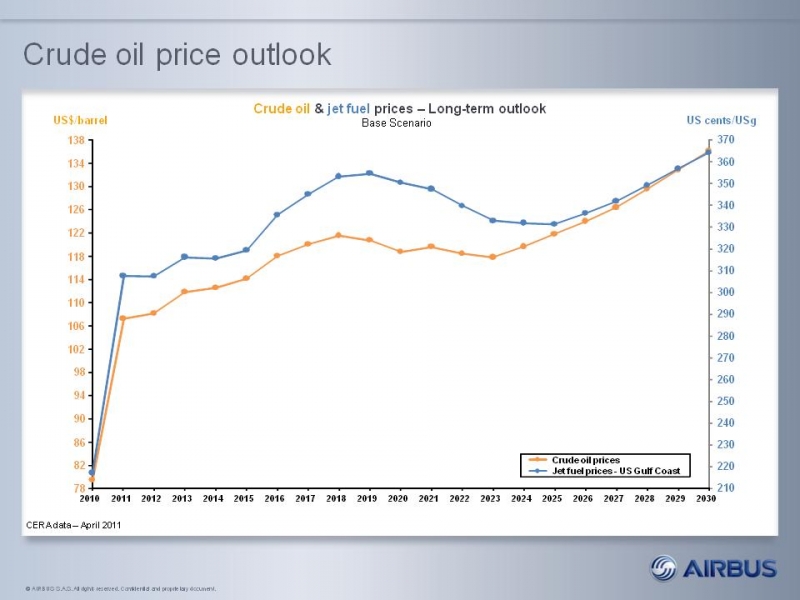

And what can we expect of future oil prices? It is difficult to say, particularly for a commodity so highly sensitive to global factors, but there seems to be an unspoken consensus among economists that oil prices will remain high and on the rise.

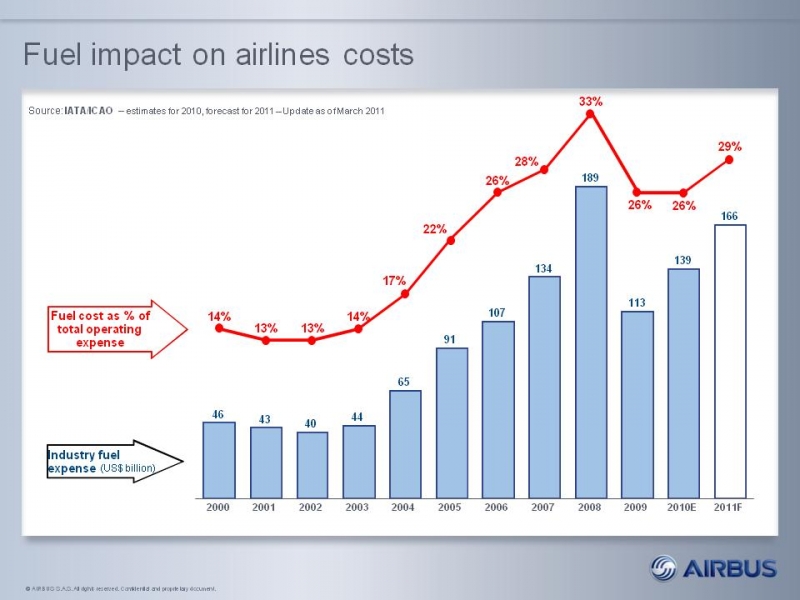

Usually, fuel represents the highest expense for an airline and one of the most difficult costs to control. IATA considers that fuel represents almost one-third of total operating expenses of an airline. It is even worst for airlines operating older generation aircraft. To understand the magnitude of this cost, consider that IATA indicated that in 2010 the total fuel cost for the industry reached a worrying maximum of US$140 billion.

To limit the impact of rising fuel prices, airlines have over time developed operational and financial measures such as flight profile optimization, hedging policies and the systematic use of more fuel-efficient aircraft. On the manufacturer side, Airbus will remain committed to research alternative energies, such as bio-fuels, while making new fuel-efficient technology available as quickly as possible to operators.

For more information contact:

Claude Pluzanski

Director Economic Analysis

claude.pluzanski@airbus.com

Amaya Rodriguez

Marketing Director, Latin America & Caribbean

amaya.rodriguez@airbus.com