Market Trends

Noticias Airbus market survey reveals critical industry insights in Latin America

Earlier this year, Noticias Airbus conducted its first market survey among key industry leaders and top executives of Latin America and the Caribbean’s major airlines. The results revealed important findings about the future of aviation in the region, insight into the evolving industry trends, factors impacting fleet decisions, Airbus perception and overall market performance over the past year.

Industry Trends: Past, Present and Future

According to respondents, the most significant positive industry trends in the past year were improvements in air traffic levels, observed by 82 percent of survey respondents, as well as improved cargo load factors, observed by 77 percent of respondents.

When asked what recent trends would be integral to the expansion of commercial aviation respondents said:

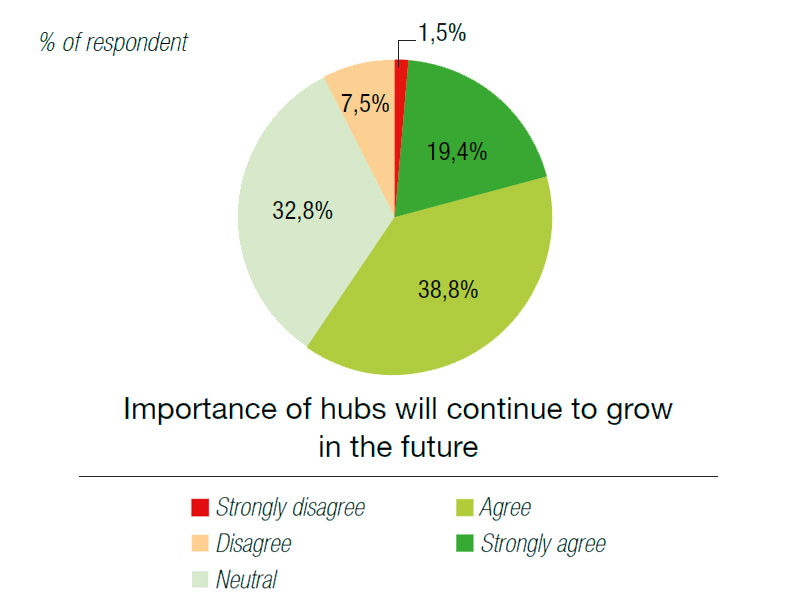

- Cargo will have a greater role than today

- Becoming part of a global alliance

- Growing importance of hubs

- Expanding the Low-Cost Carrier (LCC) model

- Increasing aircraft sizes, in particular for long haul to ensure profitability

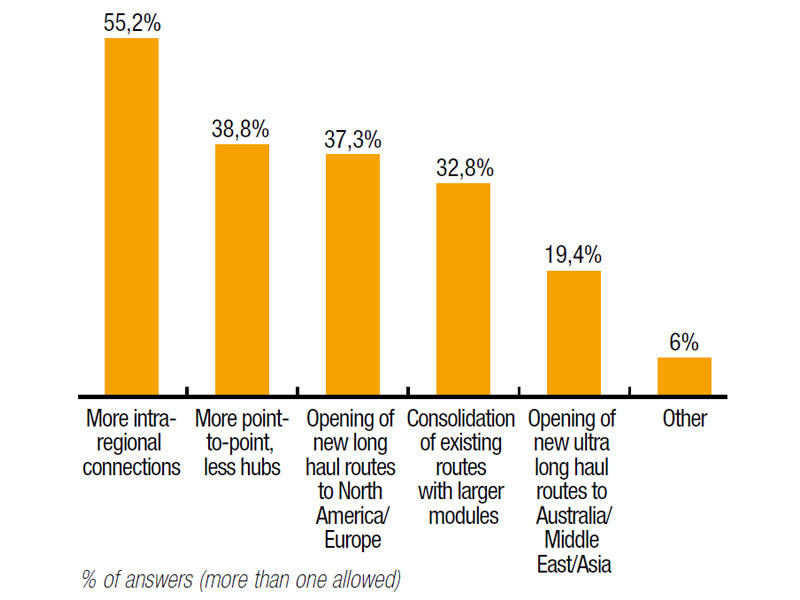

Based on the survey, Latin American and Caribbean carriers feel that industry trends such as increased intra-regional connections and regional point-to-point development, as well as opening of new long-haul routes to North America and Europe would be optimal opportunities for long-term network developments and should be prioritized.

Conversely, respondents identified major obstacles increasingly affecting the Latin American and Caribbean market, for example:

- Fuel price

- The global economic decline

- Infrastructure constraints, specifically airport capacity identified by 85 percent of respondents as being the most significant factor

Fleet Decisions: Which Aircraft to Take?

Regional airline executives reported that the most important factors they consider when choosing to operate a new aircraft is fuel burn, revenue-generating capability and fleet rationalization or commonality.

In terms of aircraft characteristics and design trade-offs, respondents indicated a preference for aircraft delivering lower costs over greater range capability, with good cargo revenue potential and capable of accommodating both high density and more comfortable cabin configurations.

In terms of fleet transition, airlines in the region are expecting at least a 15 percent cost savings per aircraft to justify a transition and generally agree that eight to 12 years is the ideal timeframe to consider when phasing out aircraft.

The Overall Perception

By and large, decision-makers in the region are optimistic about the future of aviation. Eighty percent of respondents affirmed their outlook on the industry has improved throughout the past year, with the demand for commercial aviation growing at a rate of 8.4 percent and load capacity expanding at a rate of 7.5 percent.

Compared to its competitors, region airline executives said that Airbus was a leader in having the “most integrated product family”. It is clear that Airbus welcomes a very high satisfaction rate and a strong image among the region’s airline executives, as it was also identified as a “highly innovative aircraft manufacturer” and industry leader that “delivers on promises”, and “provides quality support to customers.”

The full report with detailed results can be downloaded here.

For more information contact:

Patrick Baudis

Vice President Marketing, Latin America & Caribbean

patrick.baudis@airbus.com